Special Edition: Therapy Session

I’ve lost six figures +++.

In 5 months.

And yes, I’m eating sh*t :)

GM, and happy Saturday. Thanks for attending my first therapy session.

My apologies, this again has nothing to do with HeyCPA. We'll get back to regular scheduled programming on Wednesday :)

So, if you haven't been experiencing max pain the last few months and don't need therapy, then you can go ahead and skip it! But be honest with yourself, everyone needs therapy. Who the hell are you trying to kid??

This therapy session is for anyone and everyone who is experiencing their first bear market and has subsequently seen their net-worth plummet. Or crater, whatever you choose.

It’s been a rough couple months. And the last two weeks have been that nice little cherry on top.

Oh! Before I forget, I experienced something new this week… I lost the equivalent of my entire monthly income in three days!! What a time to be alive.

Seriously though, it’s shocking how much can change in a short time span.

Me: January, 2022

Me: May, 2022

So, am I mad? Upset? Going to throw my laptop out the window? Kinda, sorta, maybe. But this is also part of the game I chose to play. No one forces our hand, it’s all on us. Which is both comforting and frightening.

This session will be split into three sections:

- Wtf is a bear market?

- Are we screwed?

- Mindset.

Wtf is a bear market?

A bear market is when the overall market (think the S&P 500) experiences prolonged price declines. It’s usually associated with securities (stocks) prices falling 20% or more from recent highs combined with widespread pessimism and brutal investor sentiment.

Think of it this way:

- You have $200k invested.

- Bear market → You now have $160k (best case scenario).

- Everyone is scared and making irrational decisions.

The conditions right now are a little different though. Sure, the overall market is down 25-30%, but many individual stocks are down 70%+. And these aren’t your bull sh*t junior mining companies. These are quality companies that turn great profits and have massive revenue (Meta, Netflix, Shopify are all down bad). Then, you mix Crypto into this sh*t storm, and you’re looking at 80-85% price declines. Yay!

There is another nasty factor in this bear market, and that is inflation. I wrote about inflation extensively here, so I won’t dive too deep. But basically, if inflation is 10% our return must be >10% to have any return. But interest rates are going up because the Federal Reserve (the overlords of the US Economy) are trying to cool inflation. This has caused stocks to go down (quick math: Interest rates up = valuations down = stocks down).

So, you hold cash, you lose 10%.

You hold stocks, you lose a bunch too.

Well, shit. That puts us in a bit of a pickle doesn't it?

Also, let us mix in a psycho-path invading Ukraine and we have a nice sprinkle of global unrest. So things are good!!

This obviously all sounds bad, but let’s really dig in to see how screwed we are :)

How screwed you say?

Short-term? We screwed. It will be painful. It’s going to be a different ‘season’ for many people. And yes, there will be a cohort that gets hit much harder.

Long-term? Nah, we good. This is how the market functions. It’s all part of the game.

Short-term we’ll likely see further price declines, hotter inflation, and an increased number of alarming headlines. But the good news is that we’re already 6 months into this bear market, and on average bear markets last 10 months. Not too bad! Although, as we’ve seen (and I’ve felt) a lot can happen in a short period of time.

My initial inclination is that this will take us into 2023 and beyond. There won’t be a V-Shaped recovery like we saw in March 2020.

But we’ve seen this before, and as the saying goes, history doesn’t repeat itself but it sure does rhyme. And as we’ve seen in previous bear markets, this one too, shall pass.

Take a look at this graph for peace of mind. It pays to be a bull. Long-term wealth is built during these 'red' times.

Plus, think of it this way: The stock market is the only market on earth that goes on sale, and people freak out and don’t buy.

If Lululemon had a 40% off sale would you go f*cking crazy and go try to buy everything? Yes, yes you would. So, think of the stock market like that.

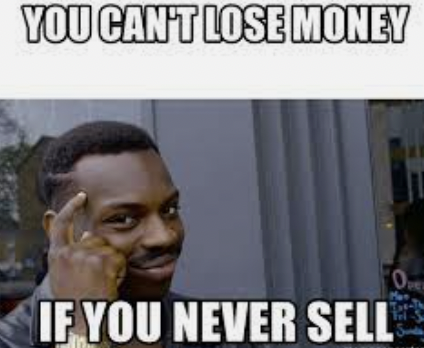

The best time to build wealth is when people are scared and emotional. If you only buy when prices are going up, and sell when prices are going down, then you’re literally abiding to “buy high, sell low”. This is bad, we want to "buy low, and sell high", or never sell.

This brings us to the next section, mindset.

Mindset: Hakuna Matata

There is so much doom and gloom out there right now, so I’m trying to ignore it. Conventional media earns revenue through clicks. And scary headlines get clicks. So, I’m kinda ‘head in the sand’ about it all.

Here are three keys I’m focusing on:

- My day-to-day life hasn't changed.

- The best time to build is when people are scared.

- Will this matter in a decade?

First, our ‘net worth’ is just some number on a screen that bumps around. It’s more of an ego driven number than something that actually matters. Sure, I’ll be a little more cautious with my spending here and there, but going out for a few less dinners is still privileged as hell.

People are resilient. And we have it really f*cking good in North America. Yes, some will be hit harder than others. But there are still many things people can control. We can make decisions and take actions, which help our situations. Sitting on our hands and complaining about prices, inflation, the world, etc. is quite useless. If we actually care, then we take action.

No action, no sympathy.

Second, building a business, your skill-set, or buying up some index-funds is the best thing we can do right now. Let other people panic, while we remain aggressive. Why? Because in 2024 when things are looking up again, you’ll be in the driver's seat. You won’t be sitting in the back and asking “are we there yet??”

Lastly, will this matter in a decade? Nah, I don’t think so. If we trust the process, and continue building and buying then we’ve done our part.

Just as people get over confident and send prices way too high, people also lose their confidence and send prices way too low. Our goal is to be the cool kid. The kid who doesn’t succumb to the bullsh*t either way. Cool as a cucumber, baby.

So, yes, I’ve lost a sh*t ton of money. Yes, it sucks, blah, blah, blah. But it’s one of those things we just gotta laugh off and continue pushing through. And remember:

Lessons learned during these times are invaluable. Remember these lessons next time you’re thinking of buying a stock that sells an exercise bike with an iPad glued to it for $160/share (now $9/share FYI... Peloton for those who are curious).

Keep building, keep buying.

Happy Saturday.